Significance of Advisor-Friendly Trusts in Modern Financial Planning

Understanding Advisor-Friendly Trusts

In the ever-evolving landscape of financial planning, there is a growing recognition of the role of advisor friendly trust. These specialized trusts represent a strategic alliance between financial advisors and trust companies, enabling enhanced asset management. Unlike traditional trust arrangements, where the trust company holds sole control, advisor-friendly trusts offer a more collaborative approach. Here, financial advisors continue to lend their expertise in asset management, allowing for innovative and responsive financial strategies that adapt to changing market conditions. This approach fosters a more dynamic management of assets and ensures that the client’s unique financial goals remain at the forefront.

The Benefits for Both Clients and Advisors

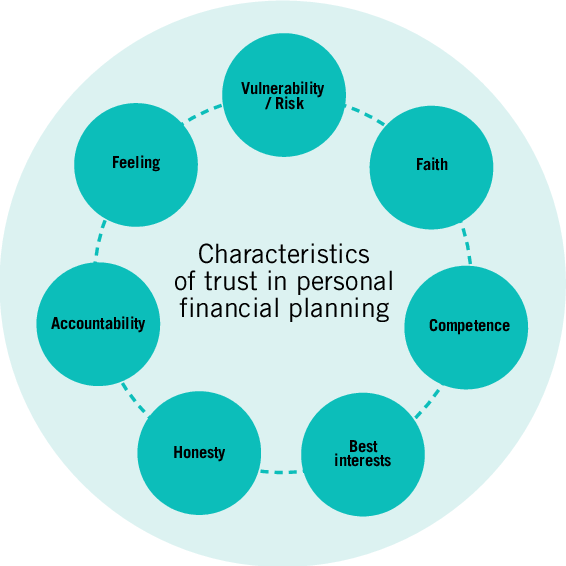

The advantages afforded by advisor-friendly trusts extend to both clients and advisors. Clients can maintain a reassuring continuity in their relationship with trusted advisors, which proves indispensable, particularly given the complexities and emotional aspects often involved in managing wealth. Trust, after all, is foundational in any financial advisory relationship, and these trusts bolster that trust. Advisors, meanwhile, are equipped with the tools needed to deliver personalized, adaptable advice while aligning it closely with their clients’ evolving needs. This dual benefit fosters a stronger, more resilient financial partnership. Additionally, when life events necessitate changes in strategy, the pre-established rapport ensures smooth transitions are informed by an intimate understanding of the client’s long-term aspirations.

The Integration into Estate Planning

When considering estate planning, advisor-friendly trusts serve as a versatile tool. They provide a means to confidently navigate the complexities of transferring wealth across generations. By clearly defining how assets should be handled, clients can ensure their intentions are accurately reflected and implemented. These trusts also offer mechanisms to minimize estate tax liabilities and sidestep common legal pitfalls. The peace of mind that comes with knowing one’s legacy is secure and will be honored can’t be overstated. Advisor-friendly trusts serve as a central pillar in comprehensive estate planning, securing wealth management that is both seamless and efficient. This underscores their importance in a well-rounded financial strategy.

Key Factors in Selecting Trust Options

Selecting the appropriate trust option is a meticulous process requiring careful thought and collaboration. It involves a deep dive into how each trust aligns with a client’s financial objectives. Clients should engage in open dialogues about the trust’s terms and conditions with their advisors. These discussions ensure alignment between the trust’s structure and the financial strategies. With these insights, clients are better positioned to make informed decisions that resonate with their short- and long-term goals.

Navigating Regulatory Considerations

Embarking on setting up an advisor-friendly trust requires a sound understanding of the regulatory landscape. These trusts are subject to various legal frameworks, each dictating different facets of trust administration and advisor participation. From jurisdiction to jurisdiction, these regulations can vary significantly. Compliance is a legal requirement and a strategic imperative for ensuring the trust achieves its objectives. Collaborating with legal and financial experts provides essential protection, helping to navigate these complexities effectively. Their advice is vital for making well-informed decisions regarding the trust’s structure and management, ensuring it aligns with regulatory standards and the client’s financial goals.

Practical Applications in Real Life

Advisor-friendly trusts are not abstract concepts confined to theoretical constructs; they’re practical tools applicable across diverse financial scenarios. For instance, a business owner might deploy such a trust to streamline succession planning, ensuring that the transition of ownership and control aligns with their strategic vision. Similarly, individuals inclined towards philanthropy might use these trusts to balance charitable objectives with financial stewardship, maintaining flexibility while overseeing the distribution of assets. This adaptability exemplifies how advisor-friendly trusts can effectively cater to complex needs, offering solutions tailored to unique circumstances while preserving the client’s financial goals.

Addressing Challenges and Misconceptions

While advisor-friendly trusts present numerous benefits, they can be surrounded by misconceptions that may deter potential users. Common challenges include misunderstandings regarding the advisor’s role, administrative fees, and the trust’s legal obligations. These misunderstandings can overshadow the trust’s potential to offer substantial value. Dispelling these myths and utilizing education to clarify these trusts’ true scope and advantages are critical. By fostering a nuanced understanding, clients and advisors can harness these instruments more effectively, tapping into their full potential to fulfill financial strategies and objectives.

The Evolving Financial Planning Landscape

As financial planning transforms, advisor-friendly trusts are anticipated to play an increasingly integral role. They present a versatile solution to the modern demands for flexibility and control within financial strategies. According to Investopedia, these trusts are expected to significantly influence the future trajectory of estate planning and wealth management. As financial landscapes shift, grasping the advantages offered by these innovative tools will be decisive in achieving financial security and longevity. Embracing these strategies allows individuals and advisors alike to prosper in an ever-changing world, ensuring that financial dreams are turned into realities.

You may also read: How Office Chairs Can Reduce Fatigue and Increase Efficiency